Download PDF Excerpt

Rights Information

What If Boomers Can't Retire?

How to Build Real Security, Not Phantom Wealth

Thornton Parker (Author) | Hazel Henderson (Author)

Publication date: 11/09/2002

This book shows that there is a bright side, however. If enough boomers work in their later years and preserve their capital, and if the country improves the way it uses capital, the results can lead to fuller lives for millions of people, healthier communities, and more sustainable economies worldwide. Parker details specific actions that individuals and organizations can take to gradually make the shift from the dangerously risky pursuit of phantom wealth to productive investments based on real accomplishments, goods, and services.

-

Debunks the popular but dangerous myth that inflating stock prices creates national wealth

-

Reveals what can be done to avert potential disaster for future retirees and the nation

-

Shows readers how to evaluate the long-term effectiveness of their retirement portfolios

Find out more about our Bulk Buyer Program

- 10-49: 20% discount

- 50-99: 35% discount

- 100-999: 38% discount

- 1000-1999: 40% discount

- 2000+ Contact ( [email protected] )

This book shows that there is a bright side, however. If enough boomers work in their later years and preserve their capital, and if the country improves the way it uses capital, the results can lead to fuller lives for millions of people, healthier communities, and more sustainable economies worldwide. Parker details specific actions that individuals and organizations can take to gradually make the shift from the dangerously risky pursuit of phantom wealth to productive investments based on real accomplishments, goods, and services.

-

Debunks the popular but dangerous myth that inflating stock prices creates national wealth

-

Reveals what can be done to avert potential disaster for future retirees and the nation

-

Shows readers how to evaluate the long-term effectiveness of their retirement portfolios

Hazel Henderson is an independent futurist, syndicated columnist, and consultant on sustainable development in over thirty countries. Her editorial columns are syndicated by InterPress Service world-wide and the Los Angeles Times-Mirror Syndicate. She serves on many boards, including the Calvert Social Investment Fund, the Cousteau Society, the Council on Economic Priorities, and the Worldwatch Institute. She also served on the U.S. Congress Office of Technology Assessment Advisory Council from 1974-1980.

To find out more about Hazel Henderson, visit her website at www.hazelhenderson.com.

CHAPTER 1

Social Security:

The Tip of the Retirement Iceberg

13

THE BASIC IDEA OF SOCIAL SECURITY is simple. Started during the Great Depression, it was devised to help all Americans prepare for their later years, particularly older people who had little chance of helping themselves.

The program takes in money from workers and their employers through payroll taxes and then pays most of it out to beneficiaries. It is called a pay-as-you-go or pass-through program because most of the money that comes in goes right back out again. It is also called an intergenerational transfer program because, in the main, the younger, working generation transfers money to the older, retired generation.

Social Security really includes two programs, Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI). OASI pays monthly benefits to retired workers, their families, and survivors of deceased workers. DI pays monthly benefits to disabled workers and their families. About 85 percent of all Social Security benefits are paid by the OASI program. In this book, we will treat the two programs as one (OASDI).

America’s Aging Population

and the Social Security Problem

Today, there are about 35 million

Today, there are about 35 million

people over age 65. By 2030, that

number is expected to double.

Americans today are living longer. As stated in the American Academy of Actuaries’ Public Policy Monograph No. 1, 1998, “Financing the Retirement of Future Generations,”1 14

When Social Security began paying benefits in 1940, only about half of 21-year-old men could expect to reach 65 to collect benefits, and those who did could expect to collect benefits for 12 years. By 1990, nearly 75 percent of them could expect to reach 65 and collect benefits for 15 years. These trends are expected to continue at least until the middle of the 21st century. At that time, an expected 83 percent of 21-year-old men will reach 65, and they can expect to live another 18 years.

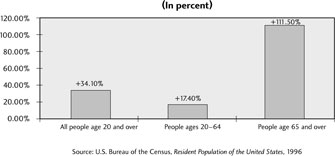

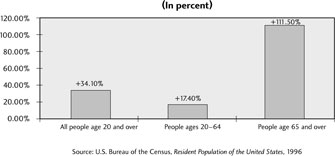

Figure 1-1, which is based on Census Bureau projections, shows how the percentage of people age 65 and over is expected to increase in relation to those ages 20 to 64.2 This trend will have important effects on the economy, society, and the country as a whole for decades.

Figure 1-1: America’s Aging Adults, 2000-35

Table 1-1 shows the same picture in more detail. Bands of shading show five major population groups as they advance in age from the year 2000 to 2035. The group shown in the darkest band includes the baby boomers, who were born during the years 1946 through 1964.

The table is divided into three large sections for those ages 65 and older, which includes retirees; those ages 20 to 64, which includes most workers; and those under age 20, or the young. Obviously, some people’s lives don’t fall neatly into these groups. Many college students are in the working-age group, some people retire before they turn 65, and others work well beyond that age.

Table 1-1 America’s Aging Population 2000–35 (In millions)15

The dark band that contains the baby boomers shows how the number of people in the 65 and over age range will grow as the boomers age. The public discussion of the Social Security problem and how to fix it is a direct result of this demographic trend.16

As members of the younger groups age, their numbers are projected to increase. This is due to anticipated immigration.

The summary under the body of the table shows that from the years 2000 to 2035:

- The total resident population of the country (all ages) is projected to grow from 274.6 million to 358.5 million, or by 83.9 million people (30.6 percent).

- The number of people ages 20 to 64 is projected to grow from 161.2 million to 189.3 million, or by 28.1 million people (17.4 percent).

- The older population of people ages 65 and over is projected to increase from 34.7 million to 73.4 million, or by 38.7 million people (111.5 percent).

- The combined effect of these increases in the population groups will be that the percentage of adults over age 20 who are 65 and over will rise from 17.7 percent to 27.9 percent. (See again Figure 1-1.)

Census Bureau projections are affected by changing immigration rates and mortality rates, and they will be revised by the 2000 census.

Nevertheless, the estimates of the number of people who will be 65 and over by 2035 are quite reliable because all of these people are alive today. The estimates for the people who will be born after 2000 (shown at the lower right of the figure) are more tentative.

The Social Security problem is that more

The Social Security problem is that more

people are living longer and expecting to receive

retirement benefits during their additional years

that will have to be paid by relatively fewer workers.17

Now that we have a feel for how the population is expected to age, we can see how the aging population will affect Social Security. Today, retirees are receiving Social Security benefits from taxes that are being paid by the large number of working baby boomers, so the program seems OK. But this situation is not expected to continue.

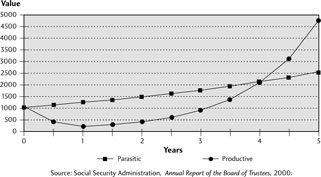

Every year, the Social Security Administration publishes three projections of how the program may operate for the next seventy-five years. Figure 1-2 is based on the year 2000 intermediate, or most likely, projection.3 The double bars show how the number of Social Security beneficiaries (short bars) will increase at a faster rate than the number of contributing workers (tall bars). (To clarify, it should be noted that by workers’ contributions we are referring to the payroll taxes that workers and their employers pay.)

Figure 1-3 depicts graphically how the number of contributing workers will decline in relation to the number of beneficiaries.

Table 1-2 provides the numbers on which Figure 1-2 and Figure 1-3 are based. The right-hand column shows that, on average, the Social Security payments to each beneficiary in the year 2000 come from the contributions of 3.4 workers. But because the number of beneficiaries is expected to increase faster than the number of contributing workers, there are expected to be only 2.1 workers per beneficiary by 2030, when the last of the baby boomers reach age 65.18

Figure 1-2: Projected OASDI Contributing Workers and Beneficiaries, 2000-75

Figure 1-3: Projected Contributing Workers per Beneficiary, 2000-75

Some observers have likened the baby boom generation to a pig in a python. That was the image that came to mind when schools had to be opened for the boomers and then closed once they graduated. The python analogy is not valid for Social Security, however, because boomers will affect it differently. According to the projection shown in Table 1-2, as they pass through their mid-sixties, between the years 2010 and 2030, the number of workers per beneficiary will decrease rapidly.

But unlike the schools that had to be closed after they graduated, the workers-to-beneficiaries ratio will not return to what it was before the boomers passed through; that is, it is not expected to go back up. This is because most younger people who are following the boomers are also expected to live long lives. As far as anybody can see, longer life spans are here to stay. Thus, for Social Security, the boomers are more like a step up to a higher plateau of operations than a passing blip on a radar screen.

Baby boomers did not cause the Social Security problem. Rather, it was caused by people living longer than they did when the program was established in the 1930s and expecting to spend their additional years in retirement. Indeed, the problem could even have occurred if birth rates had remained stable and there had not been a baby boom.

Table 1-2 Projected OASDI Contributing Workers and Beneficiaries, 2000–75

After Social Security established the idea of retiring at 65, it was used as a precedent for thousands of labor contracts and retirement plans. As people who were born during the 1930s and early 1940s started living longer because of improved health care and lifestyles, many of them retired or will retire in their mid-sixties. Boomers will defer the problem as long as they continue working, but they will make it arrive quickly if they too retire in their mid-sixties and expect to spend many years receiving benefits.19

The Financial Aspect of the Social Security Problem

In financial terms, the problem will occur when baby boomers, who are pouring record amounts of money into the program through payroll taxes, stop contributing and start receiving benefits. Anyone who has an income from a salary or wages, has savings that earn interest, and pays living expenses can understand how the program works. In a year when there is more income than expenses, there is a surplus to add to the savings. If the expenses are greater than the income, there is a deficit and the savings go down. That’s how Social Security’s finances work. In this case, the accumulated savings are called the trust fund.20

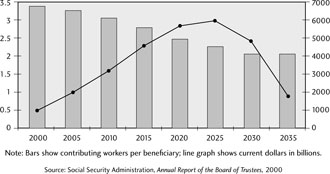

Figure 1-4 is based on the year 2000 Social Security report and provides a quick glimpse of what can happen from 2000 through 2035. The bars show the number of contributing workers per beneficiary. The curving line shows how the balance of the Social Security trust fund is expected to peak and then decline.4

Table 1-3 provides more detail on the financial ramifications. It shows annual projections for every fifth year. The annual surplus (deficit) column shows the Social Security problem.

The largest annual surplus is projected to occur between 2010 and 2015. By 2015, when boomers are expected to begin shifting from contributors to beneficiaries, the annual surplus will start to decline. Then, by about 2025, the outgo will start to exceed the total income, there will be an annual deficit, and the trust fund balance will start to decline.

The trust fund is projected to be fully depleted by 2037. The dates when events like the depletion are projected to occur change a little every time that Social Security updates its figures.

Figure 1-4: Contributing Workers per OASDI Beneficiary and Year-End Trust Fund Balance, 2000-35

Table 1-3 Social Security Financial Projections, 2000-35

For example, the 1999 projection indicated the trust fund would be depleted in 2034. The 2000 projection pushed depletion back to 2037. This was heralded by some as showing that the problem had become less serious.21

But the pattern is consistent. Under current law, the program is expected to take in more than it pays out until sometime in the twenties, then change and pay out more than it takes in. Regardless of when it happens, that change will be the most important event. The annual deficits are expected to continue through 2075, or as long as Social Security makes its projections. The projections show that the problem can’t be expected to just go away.

When the program was created it was known that annual income and benefit payments could not be projected accurately, so a reserve for contingencies was set up to handle the difference. That reserve was called the trust fund. But the term has turned out to be misleading. It implies more durability than is really there. At its projected peak near 2025, the trust fund will have only enough money to pay benefits for about three years.

But despite the claims or fears of some, Social Security will not just go broke and quit. It could still limp along even if it is not changed and the trust fund balance runs out completely. Based on the year 2000 projection, in 2037 the total income would still be sufficient to cover about 72 percent of its annual payments.22

As noted, nobody can predict the exact date when Social Security will shift from surplus to deficit. Each year, the program uses different assumptions for the Gross Domestic Product (GDP), inflation and interest rates, the unemployment rate, growth of the labor force, and other factors to make its projections. The data in Table 1-3 are from the intermediate, or most likely, projection made in 2000. The low cost projection made that year indicated that there wouldn’t be a problem because the outgo would not exceed the income for the next seventy-five years. In contrast, the high cost projection showed that the trust funds would be fully depleted by 2025.

Social Security and the Federal Budget

The federal budget has two main parts or subbudgets—the operating budget and Social Security. Either can have an annual surplus or deficit.

Imagine for a minute that the Social Security trust fund was your own money. If you earned more than you spent, you could protect some of your savings by buying government bonds. This is what many pension plans do with some of their funds, and it is what Social Security is required by law to do with its annual surpluses.

If the operating budget has a deficit when Social Security buys bonds, the program’s purchases help offset the operating deficit and so the combined budget deficit is reduced. This happened during the latter part of the twentieth century, when the operating budget had deep deficits and the trust fund was being built up, supposedly to have boomers pay for their own retirements. If the net of the two subbudgets is a surplus, then the federal budget has a surplus; this is what appeared to be the case in early 2000.

The important question is what will happen when boomers retire, the ratio of workers to beneficiaries declines, and the bonds in the trust fund must be cashed in. Table 1-3 shows that in the single year 2030—when the youngest of the boomers will start to retire—Social Security will have to cash in bonds worth $368.4 billion to get money to pay its beneficiaries (in current dollars). Where will the Treasury get the money to pay for the bonds? There are four possible sources for this money.23

- Social Security payroll taxes on workers and their employers can be increased.

- Operating programs like defense and disaster relief can be reduced to transfer money from the operating budget to Social Security.

- General taxes (other than Social Security) and user fees can be increased.

- The Treasury can sell bonds to the public.

Now, consider how each of those sources will work. - If Social Security payroll taxes are increased, the cost of retirement benefits will become a direct levy on workers.

- If operating programs are cut while general taxes and user fees are maintained, those who pay the taxes and fees will pay for the retirement benefits. Because most taxes and fees come directly or indirectly from those who are working, workers will pay for the benefits that are provided to retired older people.

- Similarly, if general taxes and fees are increased to pay the retirement benefits, they will largely be paid by workers.

- Finally, if the Treasury sells bonds, the primary domestic buyers will have to be people with disposable incomes, who are, of course, once again workers. (The reason why foreign buyers may not fill the gap will be explained in the next chapter.)

All four alternatives will have the same result. In each case, workers will have to pay more to provide benefits to retirees, and Social Security will remain a pay-as-you-go, pass-through, inter-generational transfer program.

Stocks and Social Security

24

There have been proposals to privatize Social Security by using some or all of the money that is flowing into it to buy corporate stocks. The reasons that are offered for doing this include the following:

- Stocks have historically produced higher returns than bonds.

- The country should encourage long-term investments in its wealth-creating private sector.

- Using retirement savings to buy stocks would be a step toward severing connections between Social Security and the government’s operating budget. Some see this as a desirable step toward reducing the role of government.

- Some believe that government assistance to retirees should be replaced with retirement plans that would operate entirely in the private sector.

As this book goes to press, however, there has been no adequate, publicized explanation of how any of the proposals to buy stocks could work.

Stocks provide returns in only two ways—through dividends and price increases. We will briefly examine each way here and then consider them more extensively in the next two chapters.

Dividends

Today, most companies pay small if any dividends. In 1998, Social Security paid $382.3 billion to OASDI beneficiaries. Federal Reserve Board data show that companies paid a total of $279.2 billion in dividends that year.5 Thus, even if Social Security had owned every share in the country that paid dividends, the sum of all the dividends would have been less than three-quarters of the benefits it actually paid.

Social Security obviously could never have acquired all those stocks. So it seems that dividends can’t be much help in solving the problem.

Stock Price Increases

25

Advocates of privatization say that stocks could help Social Security through price increases. However, there is a glitch that few of them seem to recognize or mention. If the Social Security program buys stocks, the only way it can get the money it will need to make benefit payments would be to sell the stocks.

Stocks can’t solve the Social Security problem

Stocks can’t solve the Social Security problem

because to help pay retirement benefits, they

would have to be sold to the same workers who

can’t continue the program as it operates today.

In other words, the Social Security program’s selling of stocks would raise the same basic question as its cashing in bonds to the Treasury: Who will have enough money to buy them? A possibility might be wealthy people, but most of them will already own securities and have little uninvested cash lying around. Therefore, the primary source of domestic buying power must be workers with adequate incomes. But when stocks are sold to workers to pay retirement benefits, the amounts of money that workers pay to buy them are pass-through intergenerational transfer payments.

The so-called solutions that would use stocks to solve

The so-called solutions that would use stocks to solve

the Social Security problem would have far worse consequences

and would make the program even weaker.

The history of trying to put Social Security on a sound foundation is revealing. As John B. Shoven wrote in his paper “The Retirement Security of the Baby Boom Generation,” published in the TIAA CREF Research Dialogues:6

In 1983, Congress adopted Social Security amendments suggested by the Greenspan Commission. At the time, it was thought the changes would keep Social Security solvent until 2063, when the youngest of the baby boom survivors would be almost 100 years old.

The idea behind some of the amendments was that the baby boom generation would prefund a portion of their own retirements. The Social Security system departed from being almost completely pay-as-you-go and adopted a plan that collected more taxes than were needed to pay contemporaneous benefits, at least during the work lives of most of the baby boomers.26

The initial forecasts in 1983 were that the system would accumulate a massive $20.5 trillion trust fund by roughly 2040, which would then be decumulated, finally being exhausted in 2063. Even though the system would ultimately require increased taxes or reduced benefits, 2063 was sufficiently distant that it could be legitimately claimed that the Social Security system was set for the long run.

Unfortunately, as the preceding figures and tables show, the changes made in 1983 didn’t work as well as expected.

Like the 1983 revisions that failed to put Social Security on a sound financial footing, using its funds to buy stocks will not change its basic nature as a pay-as-you-go, pass-through, inter-generational transfer program. However, buying stocks will subject the funds to the vagaries of the stock market and remove the guarantee that money will be available when it is needed.

When baby boomers retire, the actions of all their retirement plans are more likely to cause stock losses than gains, as the next two chapters will explain.

What You Can Do to Raise Awareness of the Problem

Before your senators and congressional representatives allow Social Security funds to be used to buy stocks, the best thing you can do is to ask them to explain to you how stocks could solve the Social Security problem. There are five main questions to ask them.

- Is there any way that stocks could help Social Security pay retirement benefits without the stocks being sold?27

- If the program buys stocks that must be sold, who could the primary buyers be, other than those who are still working?

- If the primary buyers must be workers, why will Social Security not continue to be a pay-as-you-go, pass-through, intergenerational transfer program that continues to put the burden of retirement benefits on workers?

- If the burden of paying retirement benefits would still fall on workers, what would buying stocks accomplish?

- If workers must buy most of the retired baby boomers’ stocks, to whom would the workers sell them when they retire? Why would that not be a pyramid scheme that would eventually fail?

If you ask these questions, you may be told about how in the past stocks have done so much better than other types of investments, including government bonds.

Don’t accept that answer. Never before has the U.S. government attempted to make money in the stock market. As the next two chapters explain, nothing in the history of the market has ever come close to the planned waves of selling that virtually all boomers’ pension plans and retirement accounts are designed to do. And as Part II of this volume explains, never before has so much of what this country considers to be wealth been dependent on stock prices.

There is no historical precedent for this situation. The only relevant answers to these questions will have to explain who will buy the stocks and where those individuals will get the money to buy them at the time when Social Security needs money to pay beneficiaries. Nothing else matters. If the primary buyers must be workers, then the Social Security problem will be worsened, because the program will have to sell its stocks at the same time that other retirement plans are selling them.

Appendix B provides a sample of a letter that asks the five questions shown here; readers may wish to send such a letter to their senators or representatives. (Permission is granted to quote, copy, or reproduce the letter if its source, What If Boomers Can’t Retire? by Thornton Parker, Berrett-Koehler Publishers, is identified.)28

Summary

Social Security takes in money from working contributors and pays it out to retired beneficiaries. According to current projections, the number of retirees will increase in relation to the number of workers because Americans are living longer. Something will have to give:

- People who live longer will have to work longer, or

- Workers will have to pay more to provide the current level of benefits to a larger number of retirees, or

- The current level of retirement benefits will have to be reduced, or

- Additional money will have to come from sources other than workers.

Past attempts to make baby boomers pay for their own retirements will not work because their additional payments will have been used to buy securities that will have to be sold when they retire.

It doesn’t matter whether the program buys government bonds, other types of securities, baseball cards, or beanie babies. The point is that its assets will have to be sold. The incomes of workers will make up the largest pool of money that can be used to buy the assets.

Social Security is just the tip of the retirement iceberg that millions of baby boomers are sailing toward. Few people understand that nearly all defined benefit pension plans, 401(k) plans, and individual retirement accounts have exactly the same flaw as Social Security does: they depend on buying stocks for gains. But the stocks will have to be sold to convert the gains to retirement incomes, and the largest potential pool of buying power for the stocks must be workers who have discretionary income.

In Chapters 2 and 3, we will get a good look at the iceberg.29

30The Ballad of Social Security