CHAPTER 1

What Worries Us

The inspiration for this book was a single conversation that grew into hundreds of exchanges with people from all walks of life everywhere around the world. The conversation was in 2016 with Bob Moritz, chairman of the PwC International Network. Just a year and a half earlier, in my role as global leader for strategy and leadership at PwC, I led the development of the network’s strategy—typical content such as what makes us distinctive, which capabilities do we need, and which markets should we focus on. This strategy was linked to a set of trends we believed would have a meaningful impact on the world in the coming years. These trends included such things as urbanization, shift in economic power from West to East, resource scarcity, and so on.

When Moritz and I spoke, we had just returned from separate trips to countries on four different continents. We both came back with the same nagging feeling—the world had gotten gritty and people seemed more on edge and anxious than we could ever recall in our lives. In other words, it was notably darker than the place we envisioned in 2015. Moritz asked a fundamental question: “What are people really worried about and does that affect how we should think about our business?” Answering that led me to spend the next two years in a whirlwind of conversations with leaders from government, business, and civil society as well as everyday people trying to make a decent living and build a better life for themselves and their children.

From coffee shops to boardrooms, I tried to find out how people felt about their lives and their perception of the future. Remarkably, I learned during these discussions that people in every country, at all levels of society, were in fact deeply worried. Much of what I heard is memorable, if a bit disturbing. To my surprise, there was more insecurity and pessimism than I had expected to find.

I was speaking with Amit Chandra, chairman of Bain Capital in India, about the development struggles in his country. In the middle of a lengthy discussion, Chandra said: “We do run the risk of having a revolution in India.” I was struck by that comment. “Revolution” is a big word and Chandra is no radical; indeed, his private equity company could serve as the very icon for the global capitalist establishment and he is an extremely studied man. Chandra is also a prolific philanthropist, who aims to give away up to 90 percent of his wealth to nonprofits working to improve rural development as well as capacity building in the social sector, health, and education.

1

From that perch Chandra could see that something was unwinding at the core of the world’s largest democracy.

The signs that India could suffer a revolution, Chandra told me, are obvious in the growing manifestations of extreme wealth and unrelenting poverty, sometimes right next to each other. Expensive private homes sit beside the largest slums in Mumbai. Some parts of India are rapidly leaving other parts behind. For instance, technology clusters in a variety of cities are training a new generation of technology leaders and buoying the efforts of digital entrepreneurs, increasingly consolidating wealth and inordinate national influence in these privileged areas. At the same time, conditions for subsistence farmers with little education and chances of social mobility are worsening; in some places, irrigation dams that small farmers depend upon are operating at 40 percent of capacity.

The week before the Brexit vote in the United Kingdom in May 2016, I heard a parallel story of people who feel powerless while their quality of life declines. In a taxi going from Manchester to Liverpool, the driver, who was from Liverpool, told me that he was very concerned about the outcome of the referendum. He considered his vote the most important of his life. He was choosing Leave because under the European Union, he said, his life was being altered for the worse by people he did not know, whom he could not influence, and who felt no accountability toward him. There was more: Two of the taxi driver’s friends had given up their fishing businesses because of the catch limits imposed upon them. Violent crime near his home was increasing, the local pubs and restaurants he liked were closing, and good jobs in rural areas were getting harder to find. Liverpool, he said, had become unrecognizable, its ways of life no longer sustainable. He blamed all of this on decisions made in Brussels. “It’s taxation and control without representation,” he said. “You started a war over that in America, didn’t you?”

I asked if he recognized the possible economic effect of an EU exit. The taxi driver mused: “Will it be worse than the consequences of the Second World War? We survived that.” World war. Revolution. The strident language was striking. And omnipresent.

In a coffee shop in Madrid, across from the university, I overheard at the table next to me about a dozen students having a loud and energetic conversation about, of all things, what it would take to start World War III. I asked if I could join in and told them my interest was not so much in how to start the next all-in global conflict but rather in what has gotten them to the point that they want to fantasize about it.

That sparked an equally enthusiastic discussion that centered primarily on these points, as they put it: we have almost no chance of getting a job after graduating (the unemployment rate among Spanish youths is close to 50 percent); Euro currency arbitrage in the EU has essentially put Spain under the thumb of northern countries like Germany and France, unable to afford to make investments that would improve the economic and lifestyle prospects of its residents; Spain’s technological base is falling behind other countries, making Spain less competitive globally; Spain is aging quickly and we, the young people, are going to have to support senior citizens in their retirement, but with what? Finally, the students told me, we simply do not trust our government or leaders of other institutions to do anything about it.

“So, what else should we do but figure out a way to wipe it all out and start over?” one student asked.

Not all of my hundreds of conversations were as pessimistic as the one I had with these Spanish students, but nearly everyone I spoke to was equally preoccupied with seemingly perilous and unyielding trends, and stumped about how to construct a palatable future. Among the noteworthy outcomes of the discussions with this diverse group of global correspondents, each extraordinarily unique, was that my question—What worries you the most?—elicited hundreds of different individual stories describing a wide array of circumstances and challenges (some daunting, some worse than that), but pared to their core the concerns raised were actually indistinguishable. They spoke in different tongues with wildly different inflections but ultimately portrayed problems that belied language barriers, identical in every corner of the globe.

Indeed, the things that worry us as individuals, it turns out, worry all of us as citizens of the world. Global problems are local problems and no different in North or South America, Europe, Asia, or Africa. After carefully going over the rich content in these conversations, I realized that what worries us today—and what we must focus our attention on to deliver a future that we would want to live in and that our children deserve to have—can be divided into the five ADAPT categories:

A

symmetry. Increasing wealth disparity and the erosion of the middle class.

A

symmetry. Increasing wealth disparity and the erosion of the middle class.

D

isruption. The pervasive nature of technology and its impact on individuals, society, and our climate.

D

isruption. The pervasive nature of technology and its impact on individuals, society, and our climate.

A

ge. Demographic pressure on business, social institutions, and economies.

A

ge. Demographic pressure on business, social institutions, and economies.

P

olarization. Breakdown in global consensus and a fracturing world, with growing nationalism and populism.

P

olarization. Breakdown in global consensus and a fracturing world, with growing nationalism and populism.

T

rust. Declining confidence in the institutions that underpin society.

T

rust. Declining confidence in the institutions that underpin society.

Although that tidy conclusion was compelling, as a former academic interacting with thousands of accountants on a day-to-day basis, I didn’t feel that we could claim to construct an accurate profile of global concerns solely from an informal survey, no matter how consistent the results or how broad the sample. Thus my team and I set out to determine the validity of these worries. Should people really be concerned about ADAPT? Does the data actually support their unease? We worked with colleagues from a variety of PwC territories—including Australia, Brazil, Canada, China, Germany, Hungary, India, Italy, Japan, Mexico, the Middle East, Russia, Spain, South Africa, the UK, and the United States—to examine the degree to which the elements of ADAPT were present in their countries and in what form. Here is a brief review of the results of this exercise.

2

Asymmetry

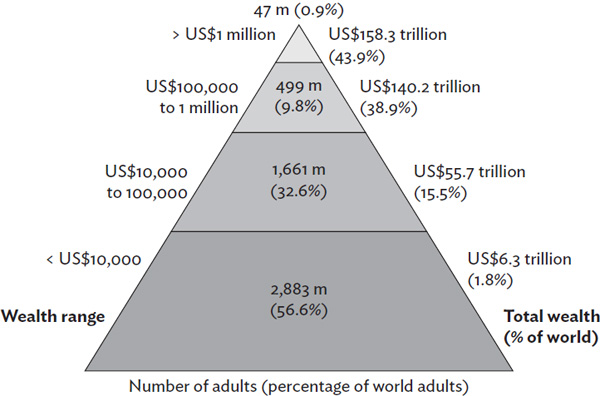

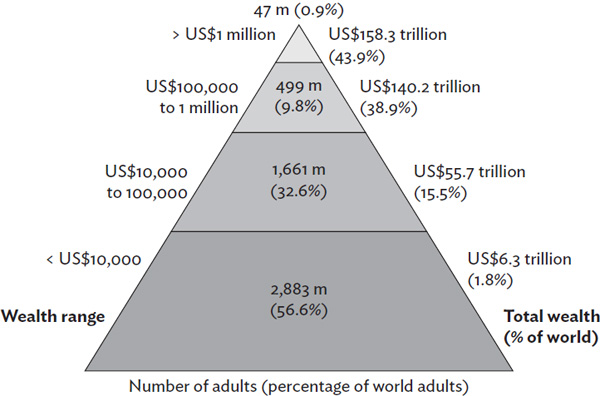

For the first time in recent history, a large percentage of parents believe that their children will be worse off than they are, chiefly because of the growing inequality in evidence today. As shown in Figure 1.1, fewer than 1 percent of the world’s adults hold over 45 percent of the world’s wealth and the number of billionaires is increasing—it more than doubled, from 1,125 to 2,754, between 2008 and 2018.

3

Moreover, in the industrialized countries of the Organization for Economic Cooperation and Development (OECD), the size of middle-income groups (those with a household net income between 0.75 and 2 times the median) has consistently decreased since 1988. The share of population that self-identifies as belonging to the middle class has fallen significantly—in the United States and Canada, for example, from two-thirds to one-half of the population since 2008.

4

FIGURE 1.1 The global wealth pyramid, 2019. SOURCE: James Davies, Rodrigo Lluberas, and Anthony Shorrocks. Credit Suisse global wealth databook 2019.

A primary factor driving both the emergence from poverty and increasing income disparity is the shift of work from higher-wage to lower-wage countries—that is, the fundamental element of globalization. Given that billions of people have emerged from poverty as a result of this process, on the surface it would seem hard to criticize. Wealth has simply been distributed from countries that had more than enough to spare to those with the greatest need.

The problem is that not all parts of the countries that contributed wealth did so evenly and neither did all parts of the countries that received wealth. As an example, consider the distribution of gains in GDP in the developed countries, those that offshored labor. In developed economies, shareholder value grew nearly 18 percent from 1999 to 2015, while real wages grew only about 8 percent.

5

Said differently, those who owned companies gained much more than those who worked for them. As for the receiving countries, India provides a useful example. While the overall GDP of the country has increased from around $500 billion to $3 trillion between 1990 and today, the difference between median income in the three richest and three poorest states grew from 50 percent in 1990 to more than 300 percent today. These poorer states are really poor, with many people living at subsistence levels.

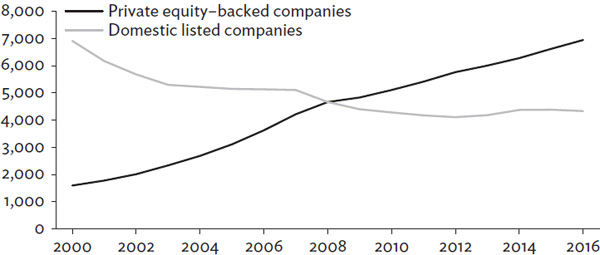

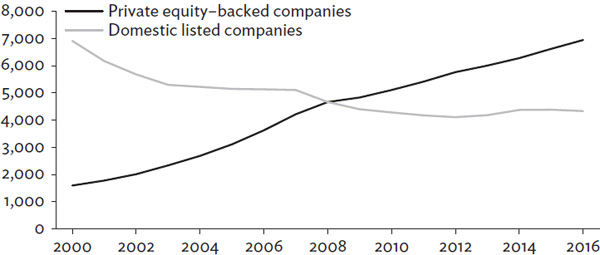

FIGURE 1.2 United States: Number of domestic listed versus private equity–backed companies, 2000–2016. SOURCE: World Bank, World Federations of Exchanges Database; Pitchbook.

A valuable way to gauge economic asymmetry is through the primary vehicles of wealth creation: investments, home ownership, and wealth redistribution.

Investments. As wealth disparity grew over the past few years, a growing number of wealthy investors have moved their money from public capital markets to private equity markets. These generally give better returns but are open to only accredited investors. To be accredited in the United States means you make at least $200,000 per year or have $1 million in net worth excluding property. To make matters worse, the number of publicly traded companies is shrinking throughout the developed world (Figure 1.2), and the percentage of individuals who are invested is also shrinking. This latter point is especially disturbing, as many people depend on investments in a defined contribution plan to provide for their retirement.

Investments. As wealth disparity grew over the past few years, a growing number of wealthy investors have moved their money from public capital markets to private equity markets. These generally give better returns but are open to only accredited investors. To be accredited in the United States means you make at least $200,000 per year or have $1 million in net worth excluding property. To make matters worse, the number of publicly traded companies is shrinking throughout the developed world (Figure 1.2), and the percentage of individuals who are invested is also shrinking. This latter point is especially disturbing, as many people depend on investments in a defined contribution plan to provide for their retirement.

Home ownership. The rise in house prices in much of the developed world suggests that many people currently under the age of forty will never be able to buy homes and thus will lose one of the main means of accumulating wealth for the middle class. In Australia home ownership by adults between ages twenty-five and thirty-four fell from 52.2 percent to 38.6 percent between 1995 and 2014, while the home ownership rate of people over sixty-five stayed constant.

6

Home ownership. The rise in house prices in much of the developed world suggests that many people currently under the age of forty will never be able to buy homes and thus will lose one of the main means of accumulating wealth for the middle class. In Australia home ownership by adults between ages twenty-five and thirty-four fell from 52.2 percent to 38.6 percent between 1995 and 2014, while the home ownership rate of people over sixty-five stayed constant.

6

Wealth redistribution. High wealth disparity also challenges a government’s ability to collect tax revenues and therefore to provide services to those that need them the most. People with extreme wealth translate very little of it into income (income tax), consume far less proportional to their wealth than most of us do (consumption tax), and hold real estate in many locations and often in their corporations (real estate tax). Moreover, they are far more able to move their money across tax regimes to locate their wealth in low tax countries or states enabled by technology.

Wealth redistribution. High wealth disparity also challenges a government’s ability to collect tax revenues and therefore to provide services to those that need them the most. People with extreme wealth translate very little of it into income (income tax), consume far less proportional to their wealth than most of us do (consumption tax), and hold real estate in many locations and often in their corporations (real estate tax). Moreover, they are far more able to move their money across tax regimes to locate their wealth in low tax countries or states enabled by technology.

Disruption

Like economic asymmetry, technological disruption has a positive side. Without it, breakthroughs in medicine, material science, nanotechnology, and computing that have greatly improved the quality of life and lifespans, democratized the availability of valuable information, enhanced educational resources, and turned a big world into a small one would have been impossible. But the negative consequences of disruption—and the scale of the challenges from it—are so potentially palpable that unchecked they could easily outweigh the good.

The most obvious concern stemming from disruption involves the loss of jobs due to artificial intelligence, robotics, and virtual reality. However, less obvious but potentially more troubling is the impact technological advances since the Industrial Revolution are having on our climate, which I will discuss in more detail in later chapters.

The combination of these disruptive forces is unraveling many of the institutions that have traditionally been a bedrock of society and the reliable centerpiece of a community. These institutions—education systems, governments, public services, utilities, media, and so many more—have generally been in existence for a long time and in part gained the trust of people because they were designed to change slowly, to be solid, reliable entities that could provide sustained value to customers, individuals, families, neighborhoods, and nations. But technology is so roiling these institutions that their steadiness and constancy are increasingly perceived as shortcomings, signs that their usefulness is limited and their relevance is minimal.

The news media is a good example. Before the late 1990s, the basic business model for news was simple: audience members subscribed to a newspaper, magazine, or TV channel, and the media owner supplemented that revenue with advertising. This steady income enabled news providers to employ professional journalists who followed a clear set of rules about what constituted good reporting. Stability made news media credible. The time it took to write, publish, produce, and distribute an article or broadcast provided layers of filters that could detect inaccuracies or made-up news.

The Internet changed all that. Seeking the efficiency of targeted advertising with trackable responses and 24/7 access to consumers, marketing budgets moved to the platform companies such as Facebook, Twitter, and Tencent. After all, that is where the readers are. More than 50 percent of Americans get their news from social media or other online sources, many of which are of dubious quality.

7

Which means that news consumption shifted to material intended, first and foremost, to attract attention: negative stories and stories that told people what they wanted to hear, at the expense of accuracy.

The consequence. We have an increasingly polarized audience, widespread skepticism about the integrity of the media, and no generally accepted way to tell “fake news” from real. Indeed, Facebook has gone so far as to say that on its platform—one of the world’s most influential information-dissemination environments ever—the difference between presenting lies and truths doesn’t exist anymore. And, in fact, shouldn’t. Despite criticism, the company has vociferously defended a policy that allows obviously false political ads to run unconstrained next to ones that strive for accuracy.

8

Trust or (Better Put) the Extreme Lack of It

Institutional distrust is a worldwide phenomenon. In nearly every region of the globe people have lost faith in the credibility of governments, corporations, media, universities, and religious organizations. A significant amount of the loss of trust reflects bad behavior: the financial crisis, institutional leaks, political corruption, police bias and brutality, and a wide range of public disclosures of egregious acts by corporate leaders and icons have all contributed.

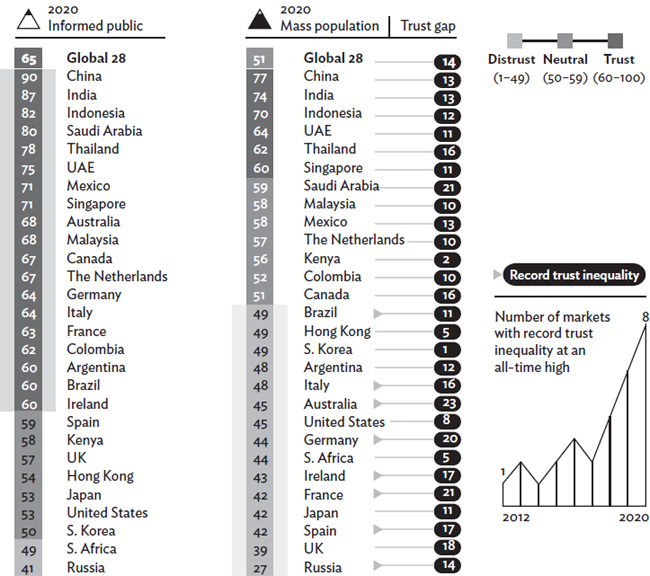

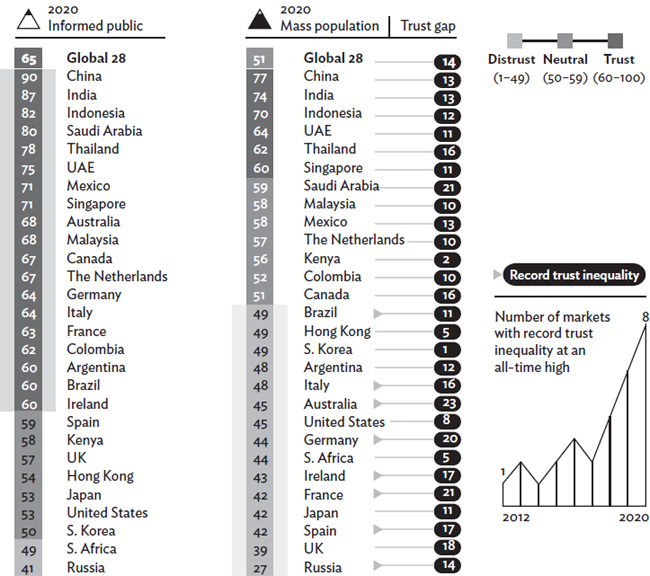

The Edelman Trust Barometer, which has tracked the perception of institutional credibility since 2001, presents a sobering picture. In 2020 twelve of the twenty-six countries surveyed had trust scores below 50 percent—meaning that the majority of people responding in each of these countries distrusted its major institutions. In the United States alone, the 2018 result represented “an 18-year low in trust across government, business, media and NGOs . . . the steepest, most dramatic decline we’ve ever seen,” according Rob Regh, chairman of US public affairs at Edelman. Although the US trust score rose in 2019, it skidded again in 2020. But even with the improvements in 2020, the survey found a record 14-point gap in trust scores (65 percent versus 51 percent) between the informed public and the mass population, with eight countries posting record levels of trust inequality (Figure 1.3).

FIGURE 1.3 Trust Index: Average trust in institutions (government, business, NGOs, and media). SOURCE: 2020 Edelman Trust Barometer, page 6.

Among the big exceptions were China and India, where more than two-thirds of those surveyed felt that institutions in all categories were worthy of their trust, and where improving economic conditions have convinced their citizens that institutions are working for them. More than likely those numbers have slipped in China and India in the past two years as their economic growth has slowed, social safety nets and the ability of the national governments to maintain basic quality-of-life standards in local communities have been tested, and political turmoil has surfaced, particularly in Hong Kong and Kashmir.

The net result of institutional distrust globally is a broad body of people who maintain a skeptical view of their future and of anyone charged with shepherding it. Consider, for example, the Gilets Jaunes protests in France in 2019 in which no solution was considered sufficient. The deeper issue at the heart of the protests was the lack of faith in the institution of government itself. Without some trustworthy institutions—organizations that not only earn and deserve trust but continue to improve in order to not lose it—civil society cannot function.

Polarization

The three primary worries already described—economic disparity, technological disruption, and institutional distrust—combine to produce a fourth bucket: namely, polarization including the allure of false or real populists and the resulting division within society and across nations. Consider how people respond to their heightened concerns. First, they say: “I want the world to look like it did. I was more optimistic in the world I knew before.” Second, they close in, rallying around people like themselves who are also experiencing the world the same way. Third, they blame those in power—the elites—for stoking their unease and fueling their uncertainties. These are not the behaviors of irrational people, but the understandable reaction of people who feel the future is likely to be worse than the past. It is the perfect seed culture for populism and nationalism (the frequent by-product of faux populism).

9

As nationalism expands its reach into every continent, its perils become more obvious. For instance, populist political leaders often take aim at migrants, blaming them for stealing local jobs, crime waves, and overusing social services. It doesn’t matter that these claims have been disputed by nearly every major study, which instead hold that immigration is almost always a boon to local economies, adding to the pool of younger workers, and powering increases in consumer activity. But by tarring the immigrant population as being harmful and destructive, nationalist leaders hope to achieve their true aims: driving tribalism in their midst and fracturing consensus or at least minimizing dialogue among their communities so that they can control the beliefs and biases of their constituencies.

Age

Age and population growth are the unseen eight-hundred-pound gorillas in the room, the invisible but potent forces that can accelerate the dynamics and negative consequences of economic disparity, technological disruption, institutional distrust, and polarization. Simply put, demographics is a global time bomb with an uncertain capacity.

The world population, which was just more than three billion in 1960, has ballooned to about eight billion people who are divided in two very different groups. One group comprises countries with large populations of young people. Places like India, where nearly 65 percent of the population is younger than thirty-five. The country has an opportunity to drive economic growth on the back of its rising working-age population, which has grown by 2 percent compounded annually since 2000 (often referred to as India’s demographic dividend) and should surpass one billion by 2030. However, whether India can actually generate the millions of jobs needed to put these young people to work is an open question that has attracted plenty of skeptics. If India fails at that, unemployment and dissatisfaction will be rampant among a very large segment of the country.

The rest of the world includes nations whose populations are shrinking and aging rapidly (most of Europe and, notably, Japan). In these countries the tax base of working-age people will have to expand greatly to cover the intensifying demands for retirement support and healthcare of a swelling over-sixty-five population.

What makes demographic trends a particularly dicey factor is the role they can play in exacerbating the least desirable impacts of the direst global trends. For instance, because of demographics, the divide between rich and poor could worsen in countries unable to provide social services for their old (if the nation is aging) or jobs for their young (if that is the dominant segment). That would fracture societies even more, pitting older, more conservative adults against restive youth unable to find a silver lining in any future scenario. Technological disruption might provide jobs for young, digitally oriented workers but at the expense of older folks replaced by machines. Nativism among older populations in developed countries could also become more prevalent in response to large numbers of young migrants seeking opportunities in countries that traditionally create jobs. Ultimately the failure of institutions to address the pressing needs of young and old would further aggravate distrust of institutions around the world.

This brief survey of ADAPT, combined with the data that supports it, establishes pretty clearly that people’s concerns are well-founded. As we plumb these issues further, something else even more disconcerting comes into focus: namely, what people say they are worried about actually foreshadows a pending set of crises, each of which, if not addressed within the next decade, is likely to result in outcomes of far greater consequence.

|

Asymmetry

|

. . . the Crisis of Prosperity

|

|

Disruption

|

. . . the Crisis of Technology

|

|

Trust

|

. . . the Crisis of Institutional Legitimacy

|

|

Polarization

|

. . . the Crisis of Leadership

|

|

Age

|

. . . Accelerating the Four Crises

|

Each crisis is urgent and must be responded to immediately with creativity, imagination, and stubborn persistence. We have only ten years to turn the tide away from these crises—or we may lose the opportunity. The following chapters delve deeply into the crises, charting their characteristics and the nature of their threat. The second part of the book offers solutions. I am not an alarmist, but I am deeply worried.

A

symmetry. Increasing wealth disparity and the erosion of the middle class.

A

symmetry. Increasing wealth disparity and the erosion of the middle class.