Download PDF Excerpt

Rights Information

Boards That Excel

Candid Insights and Practical Advice for Directors

B. Joseph White (Author)

Publication date: 08/18/2014

White offers a road map for governance success based on his experience with two of America's most successful companies, one public and one private. He knows governance research and distills it to a handful of truly useful insights for boards and directors. He provides clear guidance on the essential work boards must do, and, drawing on behavioral research, he describes how they can ensure the boardroom is a place of good information, thoughtful evaluation, and wise decision making.

The book reports on interviews with more than a dozen high-performance board chairs, CEOs, and directors, including Siebel Systems founder Tom Siebel, legendary real estate investor Sam Zell, former Harlem Globetrotters owner Mannie Jackson, GM board chairman and former Cummins chairman and CEO Tim Solso, and volunteer (University of Illinois, University of Michigan) and corporate (Hershey, Bob Evans) director Mary Kay Haben. All speak with unusual candor on what it takes for boards and directors to excel.

Find out more about our Bulk Buyer Program

- 10-49: 20% discount

- 50-99: 35% discount

- 100-999: 38% discount

- 1000-1999: 40% discount

- 2000+ Contact ( bookorders@bkpub.com )

White offers a road map for governance success based on his experience with two of America's most successful companies, one public and one private. He knows governance research and distills it to a handful of truly useful insights for boards and directors. He provides clear guidance on the essential work boards must do, and, drawing on behavioral research, he describes how they can ensure the boardroom is a place of good information, thoughtful evaluation, and wise decision making.

The book reports on interviews with more than a dozen high-performance board chairs, CEOs, and directors, including Siebel Systems founder Tom Siebel, legendary real estate investor Sam Zell, former Harlem Globetrotters owner Mannie Jackson, GM board chairman and former Cummins chairman and CEO Tim Solso, and volunteer (University of Illinois, University of Michigan) and corporate (Hershey, Bob Evans) director Mary Kay Haben. All speak with unusual candor on what it takes for boards and directors to excel.

Joseph (Joe) White is James F. Towey Professor of Business and Leadership and President Emeritus at the University of Illinois and Dean Emeritus of the Ross School of Business at the University of Michigan. He teaches U.S. corporate governance to graduate business and law students at Illinois. He is the author of The Nature of Leadership: Reptiles, Mammals and the Challenge of Becoming a Great Leader (AMACOM, 2007).

Joe is a trustee and chair of the corporate governance committee of Equity Residential, Inc. (NYSE:EQR). During his service, EQR has grown from an enterprise value of $800 million to over $30 billion, delivered annualized total shareholder return of 13 percent and become an S&P 500 company.

Joe is a director of Gordon Food Service. During his service, GFS has grown from $400 million to over $10 billion in revenue and become one of America's 40 largest private companies. He helped create governance arrangements intended to enable GFS to thrive in perpetuity as an independent family business.

Joe has extensive experience on corporate and nonprofit boards including Kelly Services, M Financial Holdings, W.E. Upjohn Institute for Employment Research, Argonne National Laboratory, American Council on Education, National Merit Scholarship Corporation and Georgetown University.

Joe was the sixteenth president of the University of Illinois from 2005 to 2009. He served as dean of the University of Michigan Business School (now the Ross School of Business) from 1991 to 2001. He has private sector experience, including six years as an officer of Cummins, Inc.

Joe brings to Boards that Excel background as an influential force in business education and talent development. As dean at Michigan, he integrated action learning into MBA studies, creating the first new curriculum model since introduction of the case method. Joe touched off movements in the business school world that elevated corporate citizenship and increased the ranks of women and minority executives.

In Boards that Excel, Joe blends governance research with practical experience and shows how to turn knowledge into action. He urges corporate and nonprofit directors to set high aspirations and provides practical advice on how to achieve them.

He shares the wisdom of experienced directors through candid and insightful interviews.Joe is a graduate of Georgetown University, Harvard Business School, and the University of Michigan. He and his wife, Mary, have two children and five grandchildren.

—Mary Kay Haben, Director, Hershey and Bob Evans, and Trustee, Equity Residential

“Joe White's Boards That Excel is an in-depth effort to reconcile the importance of governance with the ultimate mission of a board of directors. Perhaps the most relevant of many insights in the book is the recognition that performance and return on investment are ultimate measures and that superior governance contributes to those positive results.”

—Sam Zell, Chairman, Equity Group Investments, Equity Residential, Equity LifeStyle Properties, Anixter, and Covanta

“Many family businesses are late to the game when it comes to developing a disciplined and pragmatic approach to governance. The insights and principles shared in this excellent book have played a significant role in the growth and success of our multigenerational family business for over twenty-five years.”

—Dan Gordon, Chairman, Gordon Food Service

“The book provides insightful discussions of the necessary skills, attitudes, and knowledge that any board member must have. It gives well-structured coverage of best board practices. It also offers contexts for those practices by including insightful personal reflections on the role a board plays in organizational leadership from one who has thought deeply about it and actually experienced it in many important organizations.”

—Paul Danos, Dean and Laurence F. Whittemore Professor of Business Administration, Tuck School of Business at Dartmouth, and Director, General Mills

“What I've come to appreciate over the years is that at the end of the day, good governance is an art form like major league sports. It improves with hours of practice and experience. As with the team game of basketball, one gets better sooner by studying from the masters. Joe White is a master—he is the John Wooden and Vince Lombardi of corporate governance.”

—Mannie Jackson, Chairman, Boxcar Holdings; former owner and Chairman, Harlem Globetrotters; and Director, Acorn Energy, EPIC Research & Diagnostics, and Arizona Diamondbacks

“Joe White is a leader in the increasingly important field of corporate governance. He is sought out as an advisor to major corporations, is a thought leader among academicians, and an active participant in the boardroom. His book should be required reading for those presently sitting in the boardroom, those expecting to participate in the future, and those seeking the best thinking in the corporate governance world.”

—Sheli Rosenberg, cofounder and former Director, Center for Executive Women, Kellogg School of Management, Northwestern University, and Director, Equity LifeStyle Properties, Nanosphere, Strategic Hotels & Resorts, and Ventas

“Boards That Excel is a great book for students, investors, and directors to understand the essence of what makes companies tick. Joe White's insightful thoughts and observations can help anyone who reads them understand the impact directors and corporate governance principles can have on the corporation.”

—Rick Hill, former Chairman and CEO, Novellus Systems, and Director, Arrow Electronics, LSI, Cabot Microelectronics, Tessera, and Planar Systems

“Joe White's book serves as a primer for new and seasoned board members. It is filled with relevant and personal anecdotes that provide valuable insights on how to function effectively on boards. It is a must-read for anyone who has said yes to a board invitation—and it should be handed out by those doing the asking.”

—Tim Solso, Chairman, General Motors; Director, Ball; and former Chairman and CEO, Cummins

Chapter 1: High Aspirations and Strong Results--The Bookends of Great Governance

Chapter 2: Understand the Role--Stewardship Thinking

Chapter 3: Understand the Enterprise--What is a Company (School, Hospital...)?

Chapter 4: Do The Right Things--The Substance of Great Governance

Chapter 5: Do Things Right--The Process of Great Governance

Chapter 6: Embrace the Best of “Good Governance”--The Emerging Orthodoxy

Chapter 7: Other Voices--Interviews with Board Chairs, CEO's and Experienced Directors

Chapter 8: Conclusion--The “Vital Few” for Boards and Directors

Notes

Acknowledgments

Index

About the Author

CHAPTER 1

High Aspirations and Strong Results

The Bookends of Great Governance

What is great governance? This is a question that boards seldom ask. Perhaps directors assume the answer is obvious and everyone is on the same page. I don’t think that’s the case.

In this chapter, I offer my answer to that question. I make the case that the bookends, or starting and ending points, of great governance are high aspirations for and great results by the company or organization the board is overseeing.

Directors are sometimes like the stone mason who, when asked what he is doing, replies that he is constructing a wall. Less often, they are like the mason who explains that he is building a cathedral.

It’s easy to get absorbed in the work of governance—attending committee meetings; discussing strategy, plans, and results; evaluating the CEO—and lose sight of the larger purpose of board work. There is plenty of wall construction in governance, but directors should always have an eye toward cathedral building over the long term. Asking and answering the question, “What is great governance?” can help.

Let me say a word about the importance of this question. When I was a dean at the University of Michigan, I chaired the business school’s executive committee. It comprised senior faculty elected by their colleagues to advise the dean on the most consequential policy and personnel matters, especially faculty promotion and tenure decisions.

I learned many lessons in working with distinguished faculty over a decade. The most indelible of them came from Karl Weick, an eminent scholar and one of the world’s great social psychologists.

“The best research begins with the best questions,” Karl would remind us. Research methods are important, but what matters most is the question we are trying to answer.

“What is great governance?” is a best question for three reasons:

• It’s consequential. A board bears final responsibility and accountability for the performance of the organization in its charge. It’s popular to say that the buck stops with a senior executive—the CEO or president or managing director. But in fact, the buck ultimately stops with the board, so directors should have a clear and agreed understanding on what constitutes doing their job well.

• It’s difficult. Is the proper measure of great governance nothing more than company or organizational performance? What are the proper performance measures? Can great governance be achieved simply by recruiting outstanding people to the board? Does the way they work together matter too? Is great governance assured if a board checks every box on good governance scorecards? If not, then what is required?

• It’s practical. Shouldn’t every board aspire to provide great governance? How can directors achieve this high aspiration without having a shared understanding of what it comprises? And don’t those legislating, regulating, and evaluating governance practices need to understand the requirements of great governance?

The quality of governance is determined primarily by results achieved over a sustained period by the company or organization the board oversees. In the private sector in the United States, the standard measure of board performance is economic value creation for owners over the long term. In the nonprofit sector, the standard measure of board performance is mission achievement with efficient use of resources.

This view of governance is valid but incomplete. It is necessary but not sufficient. It fails to recognize the foundation on which value creation and mission achievement depend and the aspirations and vision they can help fulfill. It also ignores an aspiration shared by every board on which I have served: to maintain control of the organization’s destiny.

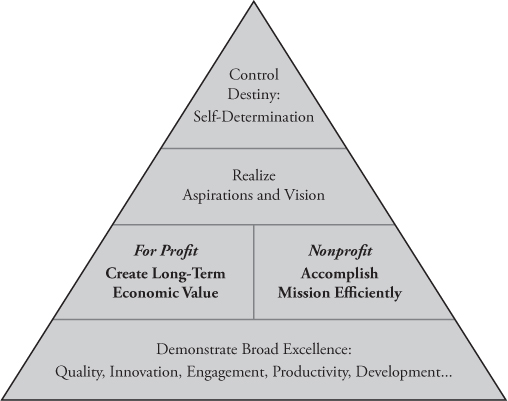

My board experience has led me to a different way of thinking about the results of great governance. Value creation and mission achievement are central, but they are imbedded in the results that create them and the higher purposes they enable. A picture describes it best. I call it the Pyramid of Purpose.

Results of Great Governance: Pyramid of Purpose

For companies, the most critical measure of board performance is long-term economic value creation, measured by market capitalization and total shareholder return for public companies and appraised or realized value for private companies. Return on invested capital over time is a good measure of economic value for both public and private companies. For nonprofit organizations, the most critical measure of board performance is outstanding mission achievement in sector-relevant ways in education, health care, human services, the arts, and so on. Efficiency is also important because nonprofit organizations are entrusted with resources to fulfill their missions and, usually, privileged with exemption from income taxes.

The foundation of value creation and mission achievement is broad excellence. This includes the company or nonprofit being admired and recognized as a leader in areas that matter such as quality, innovation, employee engagement and productivity, and leadership and people development. While no human enterprise is perfect, the customers or clients, employees, suppliers, communities, and others associated with organizations that demonstrate broad excellence value them highly. Some even love them.

That love is often based on the organization’s aspirations and vision. For example, in his 2013 end-of-year statement to Apple employees, CEO Tim Cook reportedly wrote, “I am extremely proud to stand alongside you as we put innovation to work serving humankind’s deepest values and highest aspirations.” The best organizations provide a paycheck, of course, but they give people something more as well: purpose and ability to make a difference in the world.

Broad excellence, value creation or mission accomplishment, and achieving aspirations and vision provide the results, resources, and strength to enable the board to maintain control of the company’s or nonprofit’s destiny and its precious right of self-determination.

To be effective, directors must be crystal clear about the multiple purposes of the companies and organizations they oversee. Here’s how we think about it at Gordon Food Service (GFS).

Start with broad excellence. For decades, John Gordon Sr. has reminded us, “Remember, our last name isn’t Gordon; it’s Service!” Sure enough, all around the company are visible reminders of the company’s service performance: on-time deliveries, error-free orders, accident-free miles, and so on. Service excellence is part of GFS’s broad excellence, which includes aggressive adoption of technology, strong employee engagement, high productivity, and development of leaders at every level. Broad excellence attracts customers and enables efficient operations, which together drive earnings—the foundation of economic value creation. Value creation enables the company to achieve its vision of providing customers the highest quality foodservice products and services so they can be successful, contributing to the financial security of employees through profit-sharing and enabling the Gordon family to act on their deep Christian faith by funding missions through charitable contributions. The company’s operational excellence and financial strength and its high aspirations and inspiring vision enable and motivate the board to maintain control of the company’s destiny, allowing us to chart its course and maintain independence presumptively forever.

Here’s an interesting illustration of the Pyramid of Purpose from the nonprofit world. Organization theorists have long been fascinated by the story of the March of Dimes. The reason is that if the sole purpose of a nonprofit organization were to achieve its mission, the March of Dimes organization would have closed up shop in the mid-1950s when its founding purpose in 1939—to combat polio as the National Foundation for Infantile Paralysis—was largely achieved with the invention of the Salk vaccine. But it didn’t. Instead, leadership created a new and broader mission, one that wouldn’t be so achievable! In 1958, the organization shortened its name to the National Foundation and set its sight on birth defects, arthritis, and viral disease, later narrowing its focus to prevention of birth defects, infant mortality, and premature birth.

Why did this happen? Because nonprofit organizations and for-profit companies are about more than achieving missions or creating economic value. They are bundles of competence and capability (at its best, broad excellence) that can be deployed to do useful things. Members and supporters become attached to these organizations because they provide structure, meaning, and relationships in their lives. The organization takes on a life of its own that can survive even beyond achievement of its mission. The leaders of these organizations, including the board, understand this, and like most of us, they are proud and independent. So directors strive to maintain control of the destiny of the organization for which they are responsible. Self-determination is success. Capitulation is failure.

In saying this, I do not mean to imply that every decision to sell, merge, or cease operations of a company or nonprofit is failure. For example, in 2007, Sam Zell (chairman) and the board of Equity Office Properties (EOP, a sister company to Equity Residential and at the time the largest owner of office buildings in the United States) decided to sell the company to Blackstone Group for $23 billion and Blackstone’s assumption of $16 billion of debt. EOP ceased to operate as a company. This turned out to be a great governance decision by the board because 2007 was, in retrospect, the very peak of the commercial real estate market, and EOP’s economic value was at an historic high. The board decided to seize that value and distribute it to shareholders. The sale of EOP was decidedly not capitulation. To the contrary, the board initiated the decision and maintained control of the company’s destiny to the very end.

The four levels of the Pyramid of Purpose are interconnected and interdependent. That’s why wise boards and smart senior executives strive to create a self-reinforcing, virtuous upward spiral of results across the four categories. The most challenging situation a board can face is a self-reinforcing, downward negative spiral that directors must arrest and turn around.

How does a board create a virtuous upward spiral? By setting high aspirations.

High Aspirations

Make no little plans. They have no magic to stir men’s blood and probably themselves will not be realized. Make big plans; aim high in hope and work, remembering that a noble, logical diagram once recorded will never die, but long after we are gone will be a living thing, asserting itself with ever-growing insistency. Remember that our sons and grandsons are going to do things that would stagger us. Let your watchword be order and your beacon beauty. Think big.2

—Daniel H. Burnham, Chicago architect (1846–1912)

High aspirations are the foundation of high performance. This is as true for boards and the companies and organizations they oversee as it is for every area of human performance, team, and individual. High aspirations do not by themselves assure high performance. Execution matters too. Steve Case, founder of AOL, is reportedly fond of quoting Thomas Edison: “Vision without execution is hallucination.” But high aspirations are the starting point.

Burnham, the great architect of Chicago’s stunning skyline and lakefront park system, had it right. Think about remarkable achievements. Here is an eclectic handful that I have observed in my lifetime:

• Landing a man on the moon and returning safely to earth

• Ending legal racial segregation in America and apartheid in South Africa

• Developing Singapore from a tiny, third-world country to an ultra-modern and prosperous city-state in thirty years

• Delivering letters and packages overnight anywhere in the United States

• Bringing together America’s best college graduates and neediest kids in urban and rural classrooms

• Winning the Boston Marathon eight times in ten years

• Opening higher education—college and beyond—to people with disabilities

• Creating the iPhone

Though different in character, each of these achievements began with an aspiration that it could be, should be, must be done.

On May 25, 1961, in a speech before a special joint session of Congress, President John F. Kennedy set a goal of sending an American safely to the moon before the end of the decade. Eight years later, on July 20, 1969, Neil Armstrong landed on the moon and returned safely to earth.

On August 28, 1963, in a speech at the Lincoln Memorial that culminated a decade of hard work and leadership, Martin Luther King Jr. called passionately and memorably for racial equality and an end to segregation. Less than a year later, on July 2, 1964, Congress passed the landmark Civil Rights Act of 1964. That same year, Nelson Mandela spoke of his hope for “a democratic and free society” while on trial in South Africa for his opposition to Apartheid. The system ended thirty years later with multiracial, democratic elections. Mandela, imprisoned for twenty-seven years under the old regime, was elected president.

Lee Kuan Yew led the development of modern Singapore as prime minister over three decades, from 1965 to 1990. On his watch, Singapore grew from third-world status to one of the most prosperous and modern nations in Asia. While some have criticized Lee as authoritarian and intolerant of dissent, Singapore’s development in spite of its tiny landmass and lack of natural resources is a remarkable achievement and reflective of Lee’s aspirations for the city-state.

While attending Yale University, Fred Smith reportedly wrote a paper for an economics class, outlining overnight delivery service in the Information Age. The paper may have received a C grade, but it was the origin of the idea that became FedEx. Today, the company has revenues in excess of $40 billion and employs 300,000 people.

In 1989, Wendy Kopp graduated from Princeton University. She did what thousands of Americans do when difficulty finding a job creates a crossroad in their lives: she became an entrepreneur. Reaching back to a paper she wrote for an undergraduate class, she began the arduous process of creating Teach for America. Since then, more than 38,000 participants have taught more than 3 million children nationwide.3

Jean Driscoll is an extraordinary athlete. She was born with spina bifida and grew up in Milwaukee. She was recruited to the University of Illinois to play wheelchair basketball. There, a coach, Marty Morse, spotted her as a high-potential distance athlete. The rest is history: between 1990 and 2000, Jean won the Boston Marathon, Women’s Wheelchair Division, eight times in ten years.

Steve Jobs started a new company—NeXT—in the 1980s after being ousted from Apple, the company he founded, in a boardroom coup engineered by John Sculley, the man Jobs recruited from Pepsi to be Apple’s CEO. (Jobs famously said, “Look, John, do you want to spend the rest of your life selling sugar water or do you want to change the world?”) At an Educom conference around the same time, Sculley showed an Apple video, The Knowledge Navigator (watch it on YouTube). Almost twenty years later, with Jobs at the helm, Apple launched a revolutionary product: the iPhone. It was a product that no customer requested and no competitor imagined. It converted the fanciful product portrayed in The Knowledge Navigator into reality and supercharged the smartphone industry.

Shortly after leaving Cummins in 1987, I consulted with NeXT and had the unforgettable experience of being up close and personal with Steve Jobs. His biography by Walter Isaacson4 captures Jobs perfectly. When it came to people-pleasing technology and amazing aesthetics, Steve embodied high aspirations.

I first heard the importance of high aspirations for organizations articulated by a wonderful leader, Bob Galvin, chairman of Motorola Corporation from 1959 to 1986. Bob said that the least leaders can do for their organizations is to articulate high performance aspirations. With them, he said, there’s a shot at greatness. Without them, there’s no chance. And leadership begins with the board.

Imagine if every board of every company and nonprofit organization in America explicitly agreed: our aim is to provide great governance to the company or organization in our charge. Imagine if they all understood what that commitment meant and then fulfilled it. The entire distribution of governance performance in America would shift higher. It would be a wonderful thing for companies, nonprofits, and the nation that would set an example for the world.

High Aspirations Governance: Two Examples

GFS and Governance

GFS had been around for almost ninety years when I met Paul and John Gordon in 1987. That was the year they decided to take steps to ensure quality governance, orderly management succession, and family control for generations into the future. It was not quite clear what those steps should be. Dave Gray and I helped the family identify and implement them.

GFS has been a remarkable story of growth and high performance in the ensuing twenty-five years. It has also been the story of a family dedicated to customers, employees, and service. The Gordon family practices servant leadership as a guiding principle in its stewardship of the company and expects the leaders of the company to do the same.

High Aspirations. The creation of governance arrangements for GFS was built on high aspirations for the company’s future. Four stand out.

First, Paul and John wanted a governance structure that would enable the company to operate successfully for decades, even centuries, into the future—through multiple generational changes in family and management. They wanted, in other words, governance that would enable GFS to be a successful company in perpetuity.

We were acutely aware that few companies, public or private, achieve this goal. Corporate change and mortality statistics are sobering. Of the original companies in the Fortune 500 published in 1955, about 90 percent have disappeared from the list. This reflects the death of some companies, the absolute or relative decline of others, and the acquisition, merger, and loss of original identity of many. Few family businesses make it beyond two generations for a variety of reasons, including inadequate capital, scaling problems, failure to develop leaders, family desires for liquidity, estate taxes, and so on.

The stark reality of corporate mortality reminded us how important governance would be for GFS to have a chance to continue in perpetuity. Governance would have to anticipate and prevent or resolve all the issues that lead companies to lose control of their destinies, disappear, or die.

Second, Paul and John aspired for GFS to be a high-performing growth company. They wanted, somehow, to ensure the board would, every year, find the sweet spot between stretch goals and acceptable risk. This is a vital challenge for every board. Let me explain.

The board, as management’s boss, must set goals, provide incentives, and monitor results to motivate high performance. Directors are also responsible for managing the enterprise’s risk profile through project approvals and denials and balance sheet management. Deep financial strength is the best insurance policy against a company’s becoming a mortality statistic. Excessive risk aversion leaves the organization lethargic and subject to decline and slow death (e.g., General Motors in the 1980s and 1990s). By contrast, extreme stretch goals and financial incentives can lead management to take excessive risks with crash-and-burn results (e.g., Lehman Brothers in the 2000s).

As entrepreneurial leaders of GFS, Paul and John managed this balance point personally. They constantly reinvested in the business by living modestly, thus minimizing their personal demands on company resources and enabling GFS to take prudent investment risks to expand and grow. Looking ahead to the time when the board would manage the balance point, they wanted to be sure the company became neither lazy and complacent nor excessively leveraged and risky.

Paul’s and John’s third aspiration was that GFS remain focused on food service and not be easily distracted by the siren song of unrelated diversification. They also preferred that the family resist the temptation to become passive investors. They understood that financial returns must be acceptable and the company would have to adopt and adapt to new technologies and circumstances. But the family had made its living for over ninety years in the food business, and they believed in its staying power. As Paul’s wife, Dottie, liked to say, “It might be green beans or filet, depending on the times, but people will eat.” Food service was not likely to become an obsolete industry.

Fourth, Paul and John made it clear that they wanted the company to have strong leadership. They understood the need for a board that expanded beyond the two of them and their sons in the business. But they had no appetite for management by committee. They emphasized the importance of a strong CEO. They also expressed the aspiration that GFS remain private, entrepreneurial, nimble, and intensely focused on customers and service even as it grew rapidly into a large and geographically far-flung enterprise.

Paul and John set high aspirations twenty-seven years ago as we wrestled with the task of creating modern governance arrangements. In summary, they sought

• a company that could survive in perpetuity;

• a high-performing growth company with stretch goals and acceptable risk;

• a company focused on food service; and

• a strongly led, entrepreneurial, service-oriented company.

Governance Structure and Philosophy. Dave Gray and I digested all this and, working closely with the Gordons, turned to the task of designing governance for GFS. We did homework on well-known and widely admired private companies, like Cargill and S.C. Johnson, that had survived beyond a couple of generations, grown, and performed well. But mainly, we thought deeply, envisioned the future through multiple generations of continued family control, tried ideas on each other, and gradually developed an approach.

Two main elements emerged: a two-tiered governance structure and a statement of philosophy from Paul and John to future generations of family and directors. I came to think of the structure and philosophy as hardware and software, the former comprising the what of great governance and the latter the how and the why.

The two-tiered structure was the result of long debates about the merits of a smaller versus larger board. By small, we meant no more than five people. Remember, just two people had governed the company for decades! The great attraction of a small board was that it could act decisively and move quickly. We also expected that fewer people would mean fewer politics. We figured out, in detail, how a five-person board could be appointed and operate in a way that maintained family control while ensuring a strong family or non-family CEO and bringing in at least one outsider (i.e., neither a family member nor company employee).

But as we thought about the governance requirements of a large and growing enterprise and the need to develop younger directors while retaining the wisdom of senior members of the board, having only five directors felt too limited. We considered creating a board of up to nine people but were concerned that control of the company might become cumbersome and politicized.

For a while, we were hung up on the horns of this dilemma. Then we arrived at a solution.

We decided that the governing body that would connect to the family and exercise control of the enterprise would be a five-person board of advisors. GFS would have a board of directors of up to nine members to directly oversee the company. To avoid duplication and confusion, we empowered the board of advisors to appoint themselves as the company’s board of directors with the ability to appoint up to four additional directors. We sought the benefits of a small board to represent the family and control the company and a larger board to accommodate all of the talent required to govern.

The initial GFS board of advisors was composed of Paul and John plus Paul’s eldest son, Dan, Dave Gray, and me. The board of directors was composed of these five plus Paul’s and John’s other two sons in the business, Jim and John Gordon Jr. Paul served as chairman and John as vice chairman of both boards. There were no committees; the board handled all matters.

In an exemplary act of leadership, Paul and John soon insisted that the five-person board of advisors be composed of their three sons, Dave Gray, and me (i.e., they gave up their positions as advisors). This membership of the board of advisors has remained unchanged for twenty-five years. We are preparing now for orderly succession during the next decade.

With regard to operating philosophy—the “software” of governance—Dave and I observed early on that Paul and John had strong views about business and life. Some had direct implications for governance and leadership, such as an attitude of stewardship about the company, a philosophy of servant leadership about the people, a very cautionary approach to debt, and a belief that the family should remain focused on the industry they knew. Other things were more personal, including their deep Christian faith, its guiding influence in their lives, and their desire to devote resources to spreading God’s word around the world rather than living lavishly.

As Dave and I thought about the in perpetuity intention for GFS, it struck us that there would be future advisors and directors who would have no idea about the thinking of these entrepreneurial owners if we didn’t capture and preserve it for future dissemination. With this in mind, we asked Paul and John to write a Letter of Wishes. The title was chosen carefully. The brothers wanted their thinking to be a guide and an inspiration, not a straitjacket or set of commandments. They understood that future advisors, directors, and family members would need freedom and flexibility to make sensible decisions for their times and situations.

The Letter of Wishes makes permanent Paul’s and John’s high aspirations. It is a profession of their Christian faith. It addresses their views about the purpose of the company, the perpetuation and growth of the business through future generations, the role of family in the business, and the structure, financing, and focus of the company.

EQR and Governance

When Sam Zell called me in 1993 about joining the board of EQR, he made it clear that the goal was to build a great public real estate company. As the board came together and began its work, we breathed life into the aspiration Sam had articulated and came to understand what it would mean for the company and its governance.

High Aspirations. Three things defined greatness for EQR.

• First, being a leader in creating the new, public real estate investment trust (REIT) industry. The industry had been tarnished two decades earlier by the failure of companies with too much debt and egregious related-parties transactions (deals that benefited company insiders at the expense of other shareholders). The industry needed a reset. The liquidity crunch experienced by private real estate companies in the early 1990s encouraged or forced many to go public and provided the reset opportunity. Sam was enthusiastic about what quality public companies could mean. For shareholders, he said, they would provide liquid real estate—attractive yields in the form of dividends and capital appreciation of real estate assets with the liquidity of public company stock. For the industry, public ownership held the promise of more rational capital allocation and a reduction of the boom-and-bust development cycle that had long plagued commercial real estate.

• Second, capitalizing on the unique window-of-opportunity in the early 1990s to acquire real estate assets at great prices. Distressed owners and the federal government were unloading an unprecedented amount of property on the market. Sam coined a mantra for the struggling commercial real estate industry in 1991: “Stay alive ‘til ‘95!” Meanwhile, a new public REIT could build a once-in-a-lifetime portfolio of quality real estate assets at rock-bottom prices. There were two requirements: speed and capital. From the outset, being smart, decisive, and quick to act were EQR core competencies.

• Third, being a leader in value creation. This would require serving residents well, operating buildings efficiently, and buying and selling properties advantageously. Central to EQR’s investment thesis was that strong demand and limited supply would drive earnings and value creation.

In these three ways—leading creation of a new industry, capitalizing on a unique window of opportunity, and creating value—Sam set high aspirations for EQR and its board from its birth as a public company in 1993.

Governance Structure and Philosophy. What were the implications for governance? In terms of people, EQR needed a board composed of individuals who could quickly develop mutual respect and trust and excellent teamwork because timely decision-making was of the essence. The board required a mix of real estate professionals and people with other skills such as finance and law. From the beginning, EQR had a majority of independent trustees. As board colleague Jim Harper told me at the time, Sam counted on EQR trustees to have real, not just technical, independence. “Joe,” he said, “Sam is a force. He’s smart and opinionated and no shrinking violet. He’ll be counting on each of us to think independently and speak up.”

Structurally, the board had a chairman (Zell) and CEO (Doug Crocker). From the outset, the board had three committees: executive, audit, and compensation. Speed combined with good judgment would require an executive committee of Sam, Doug, and independent trustees in whom the entire board had confidence to make transactional decisions between board meetings. The audit committee was charged with maintaining high credibility with capital markets. This required quality financial reporting and internal control. The compensation committee was charged with designing pay for performance (i.e., incentives for management to focus on value creation to benefit owners). The 1990s were a period of great ferment in corporate governance. Accordingly, the EQR board established a governance committee to ensure board practices in the best interests of the company’s shareholders and stakeholders.

It was apparent from the outset that the EQR board would be fast company. Zell, Crocker, then-CFO (now CEO) David Neither-cut, and trustees like Errol Halperin, Sheli Rosenberg, and Jim Harper were among the smartest business people I’ve ever met. Over the years, I would tell trustee candidates, “You need to be quick on the uptake!” There has never been room for bureaucracy on the EQR board. Detail work is done in committees. The board focuses on the big picture (strategy, risk, acquisitions, and divestitures), financial matters (operating results and the balance sheet), and the leadership team, especially the CEO. Things move fast. But when a matter is not obvious or there are differences of view, Sam as chairman slows the action to get viewpoints aired, then pushes for decisiveness. This fast company process fits EQR’s business situation (multiple windows of opportunity when the combination of scale and speed is a competitive advantage) and the people around the table.

There have been many chapters in EQR’s history since 1993, including its governance. The board has been as small as nine people and as large as fifteen. The company’s focus within a framework of strong value creation has shifted over time: from pell-mell acquisition in the early years, to operational effectiveness, to repositioning the portfolio from garden apartments across the United States to top-quality medium-and high-rise buildings in high barrier-to-entry markets on the east and west coasts. A strong balance sheet has always been a priority. The approach to development has been conservative. There have been only a few small missteps. For example, our adventures in the furniture rental business served to remind us what our core competence is and is not.

In line with Sam’s high aspirations, EQR has been a leader over the last twenty-one years in creating a vibrant public REIT industry. Today, many investment advisors recommend that REITs be part of any well-diversified portfolio. EQR’s value creation has been strong. Between the initial public offering in 1993 and the end of 2013, EQR’s stock has quadrupled. REITs are required to distribute at least 90 percent of their taxable income to investors, so EQR has provided a steady stream of dividends to investors during two decades of paltry interest rates on bonds and savings accounts. As Sam predicted, the modern public REIT industry has made liquid real estate a reality for investors. EQR has helped lead the way.

Conclusion

Great governance produces strong results in the form of economic value creation for companies and efficient mission achievement for nonprofits. This performance is built on a foundation of broad excellence, facilitates achievement of aspirations and vision, and enables the board to control the organization’s destiny.

Great results are built on high aspirations. This is as true for companies and nonprofits as it is for individuals. The first task of the board is to set such aspirations for the enterprise and itself.

With this done, directors need to develop the proper mindset with which to oversee the company or organization in their charge. A few guiding ideas compose the stewardship thinking that underlies great governance. We turn to them next.