Download PDF Excerpt

Rights Information

The Shareholder Action Guide

Unleash Your Hidden Powers to Hold Corporations Accountable

Andrew Behar (Author)

Publication date: 10/07/2016

—Robert Reich, former US Secretary of Labor

Want to make misbehaving corporations mend their ways? You can! If you own their stock, corporations have to listen to you. Shareholder advocate Andrew Behar explains how to exercise your proxy voting rights to weigh in on corporate policies—you only need a single share of stock to do it. If you've got just $2,000 in stock, Behar shows how you can go further and file a resolution to directly address the board of directors. And even if your investments are in a workplace-sponsored 401(k) or a mutual fund, you can work with your fund manager to purge corporations from your portfolio that don't align with your values. Illustrated with inspiring stories of individuals who have gone up against corporate Goliaths and won, this book informs, inspires, and instructs investors how to unleash their power to change the world.

Find out more about our Bulk Buyer Program

- 10-49: 20% discount

- 50-99: 35% discount

- 100-999: 38% discount

- 1000-1999: 40% discount

- 2000+ Contact ( bookorders@bkpub.com )

—Robert Reich, former US Secretary of Labor

Want to make misbehaving corporations mend their ways? You can! If you own their stock, corporations have to listen to you. Shareholder advocate Andrew Behar explains how to exercise your proxy voting rights to weigh in on corporate policies—you only need a single share of stock to do it. If you've got just $2,000 in stock, Behar shows how you can go further and file a resolution to directly address the board of directors. And even if your investments are in a workplace-sponsored 401(k) or a mutual fund, you can work with your fund manager to purge corporations from your portfolio that don't align with your values. Illustrated with inspiring stories of individuals who have gone up against corporate Goliaths and won, this book informs, inspires, and instructs investors how to unleash their power to change the world.

Andrew Behar, As You Sow CEO, has 30 years of experience as a Senior Executive and strategist in the clean-tech, communications, and life science sectors. Prior to joining As You Sow, Andrew founded and was CEO of a clean-tech start-up developing innovative fuel cell technologies. He served as COO for a social media agency focused in the sustainability space and has been a strategic consultant in the nonprofit sector. He has founded and run start-ups in the medical device and communications areas and serves on the boards of several high-tech innovation companies. Andrew is also an elected board member of US-SIF, the Forum for Sustainable and Responsible Investment.

—Bevis Longstreth, former Commissioner, Securities and Exchange Commission

“Engage, divest, invest! We need to align our capital with the world in which we want to live and flourish. The Shareholder Action Guide provides an excellent road map to get us there.”

—Kat Taylor, Co-CEO, Beneficial State Bank

“Knowledge is power . . . and this comprehensive guide to shareholder activism will supercharge the work of holding corporations accountable and making positive change in the world. A must for every activist's toolbox.”

—Michael Brune, Executive Director, Sierra Club

“The Shareholder Action Guide empowers every investor to work with corporations to be part of the solution. This is a must-read to help mobilize a shareholder movement that will have a major impact on climate change and other critical issues of our time.”

—Timothy E. Wirth, former US Senator (Colorado) and Vice Chair, United Nations Foundation

“With practical information and compelling accounts of how shareholders are pushing corporations to improve their conduct, The Shareholder Action Guide is a must-read for investors mystified by the proxy process yet eager to align their assets with their values.”

—Fran Teplitz, Executive Codirector, Green America

“The Shareholder Action Guide is an incredibly important and timely reminder of what each of us can do to challenge corporate and CEO misconduct. It's a must-read for anyone looking to influence how companies treat their employees and our planet.”

—Eugene “Rod” Roddenberry, President & Director, The Roddenberry Foundation

“Both a historical primer on the movement's founders and a practical how-to manual, The Shareholder Action Guide demystifies the process of shareholder advocacy for concerned investors looking to catalyze enduring social and environmental change through the management of their investments.”

—Joshua Zinner, CEO, Interfaith Center on Corporate Responsibility

“This inspiring work empowers shareholders, both large and small, to hold corporations accountable. These incredible stories of shareholders who have made real change are a powerful call to action.”

—Ben Cohen, cofounder, Ben & Jerry's, and Head Stamper, Stamp Stampede

“I have been involved in shareholder advocacy for over forty years. I don't think I have seen such a thorough presentation in one place of its nuts and bolts. The Shareholder Action Guide is a great history and how-to that empowers every investor and comes at a critical time.”

—Rev. Michael H. Crosby, member, Midwest Capuchin Franciscans, and Executive Director, Seventh Generation Interfaith Coalition for Responsible Investment

“Andrew Behar does a masterful job reminding anyone who has investments of our power to influence corporations, which are among the most politically powerful entities on earth today. Citing actual examples of how investors holding a relatively modest amount of stock can push companies to be more sustainable, The Shareholder Action Guide provides a wonderful combination of hope for the future and practical advice, in accessible, jargon-free language, on how shareholders can wield their influence. For all who thirst for social and environmental justice, this is an important book to read.”

—Kimberly Gluck, Managing Director, Walden Asset Management, and member, Women Donors Network

“The Shareholder Action Guide restores the connection between us and our money with practical, achievable steps to push for more accountability and inspiring stories of shareholders who have already made a difference.”

—Nell Minow, Vice Chair, ValueEdge Advisors

“Since Citizens United gave corporations the rights of citizens, I've wanted to hold them accountable for their bad business practices. The Shareholder Action Guide gives everyone a road map on how to do just that.”

—Carlynn Rudd, Principal, Caribou Strategies, and Board Member, As You Sow

“As You Sow and Andrew Behar have helped lead the charge for shareholder action in the United States on environmental and societal issues, often ahead of the curve. Here is a unique opportunity to learn from those that actually do.”

—Cary Krosinsky, Lecturer, Yale College and Brown University

“We theoretically live in shareholder capitalism. It's shocking, then, how much energy corporate management expends making sure that shareholders' voices are muffled—and how creative, energetic advocacy can remove the gag. Find out how!”

—Carl Pope, Principal, Inside Straight Strategies, and Board Member, As You Sow

“Inspiring stories of successful shareholder advocacy, side-by-side with practical steps for those who want to effect real change through the power of their investments.”

—Jennifer McDowell, member, Women Donors Network

“It is exceedingly important to capture history and accounts of how shareholder advocacy has impacted the policies and practices of thousands of companies over the last forty-five years. Behar's book provides an important look at this inspiring history and the differences it helped catalyze.”

—Tim Smith, Director of ESG Shareowner Engagement, Walden Asset Management

“This book is a must-read for every individual and organization committed to aligning their investments with their mission. Shareholder advocacy is a powerful demonstration of a shared-leadership, shared responsibility model benefiting everyone from investor to community to the environment. Inspiring!”

—Lisa Worth Huber, PhD, Chair, Board of Directors, National Peace Academy

“This book shows how everyday investors can become energized and effective advocates on a range of critical issues facing our planet. Learn directly from pros who share pioneering advocacy wins, part of an important history of change from the community of responsible investors over the last thirty years.”

—Matt Patsky, CEO, Trillium Asset Management

“This may be the most important book you will ever read if we are going to make the ‘Great Transition' from fossil to renewable energy. Behar has given us the framework, architecture, and blueprint on how we get from here to there.”

—Chip Comins, Chairman and CEO, American Renewable Energy Institute

“The Shareholder Action Guide holds the key to empower investors to drive business innovation globally and make the great transition off of fossil fuels to a renewable energy economy. The choice is in our hands as engaged shareholders.”

—Diana Dehm, Host, Sustainability News & Entertainment Radio

“As shareowners of public companies, we have the right, the responsibility, and the power to help guide companies to be positively impactful. The Shareholder Action Guide clearly shows how to be an impact investor in the public markets.”

—Steven J. Schueth, President, First Affirmative Financial Network, and Host/Producer, The SRI Conference

“Shareholder advocacy is changing the defi nition of ‘business as usual.' Mixing personal stories, strategy, and practical how-tos, The Shareholder Action Guide shows how any shareowner can help build a better world.”

—Michael Passoff, CEO, Proxy Impact

“For all investors—small and large—who want to make a difference, The Shareholder Action Guide offers clear, practical advice. Through shareholder action, investors can urge corporations to change course.”

—Kathy Hipple, Corporate Finance Professor, Bard College

“Could the power of ownership change the world? In this excellent primer, Andrew Behar explains how shareholders can hold corporations accountable for their actions and improve both performance and profitability. This is a timely and thoughtful guide to competent and effective activism toward a more durable, resilient, and just society. Behar has written a practical game plan for a world better than that in prospect. The point is that we are not helpless to effect positive change. And that is a powerful message and a clarion call to act.”

—David W. Orr, Senior Advisor to the President, Oberlin College

“Through bestowing charitable status, US tax laws enable foundations to leverage social change. Foundations are therefore duty bound to society to use every available tool. This guide provides insights and means essential to foundations to fulfill their social contract.”

—John Powers, President, Prentice Foundation

“Shareholder resolutions are an emphatic ‘do something' message to corporate leaders from a constituency they can't ignore—the investors who own the company. This excellent guide tells you how to do that.”

—Jon M. Jensen, Executive Director, Park Foundation

“The only economy that will allow us to survive the 21st century is one based on ethics, human rights, and sustainability. It will be an economy where people have more rights than corporations and where companies will be accountable to a broader set of stakeholders rather than only shareholders. The Shareholder Action Guide is a critical arrow in the quiver to bring this new economy to reality.”

—Gary Cohen, President and cofounder, Health Care Without Harm

CHAPTER

1

Who Let the Dog Out?

If your dog escaped from your yard and rampaged around the neighborhood, knocking garbage cans into the street, your neighbor would probably show up at your door, and you would, of course, accept responsibility and clean up the mess, scold your dog, and fix the fence.

OWNERSHIP IMPLIES RESPONSIBILITY

What about your investments? Perhaps, like 91 million Americans, you own stocks directly in companies or funds that are composed of dozens, hundreds, or even thousands of stocks. Are you responsible for the behavior of these companies?

Figure 2: Are you responsible for your dog’s actions? Photo used with permission of the author.

If a company that you own causes an oil spill that does damage (like your dog did in the neighborhood), would you feel that this is your responsibility? Or would you think, “That’s for management and the board to deal with.” Do you give it a second thought? Do you even track the activities of the companies that you own?

Although the corporation shields investors from direct legal liability, moral responsibility is another story: Do you want a company that you’ve invested in—and that is benefitting you financially—to act in ways that are contrary to your values? In addition, can you use your influence as a shareowner to help your company become more profitable and have a positive impact on society by adopting policies that enhance its image, increase employee retention, and reduce risk from liability?

Supreme Court Justice Louis Brandeis stated the matter succinctly, “There is no such thing to my mind … as an innocent stockholder. He may be innocent in fact, but socially he cannot be held innocent. He accepts the benefits of the system. It is his business and his obligation to see that those who represent him carry out a policy which is consistent with public welfare.”4

THEORY OF CHANGE

For our society to be sustainable—that is, to provide sustenance and continuity for all people and ecosystems for generations to come—we must first acknowledge that today we are out of balance and need to find a way to change.

Over the past century corporate power has become the most dominant force on the planet. Of the 150 largest economic entities in the world, 87 are corporations—that’s 58 percent.5 This concentration of resources gives corporations power and influence over their employees, communities, and the governments in which they operate. This lopsided power relationship means that corporations can disregard the impact that their activities have on the rest of society. They can commit human rights abuses and choose to pollute low-income and minority communities near their plants. They can manipulate political power to their financial advantage. They can choose to ignore dire warnings of global catastrophe caused by their activities. If local governments intervene, the corporation can shift their activities to the other side of the globe or alter the government.

According to US Senator Elizabeth Warren (D-Mass.),

Corporate criminals routinely escape meaningful prosecution for their misconduct. In a single year, in case after case, across many sectors of the economy, federal agencies caught big companies breaking the law—defrauding taxpayers, covering up deadly safety problems, even precipitating the financial collapse in 2008—and let them off the hook with barely a slap on the wrist. Often, companies paid meager fines, which some will try to write off as a tax deduction.6

What the executives who head corporations cannot do is ignore the people who own their companies. They work for the shareholders. While shareholders indeed have enormous power, most still care primarily about maximizing profit. However, a growing number are choosing to leverage their power to improve the environmental, social, and governance ESG practices of the public companies they hold for the dual purpose of maintaining long-term profitability and positively impacting society and the planet. Once motivated, shareholders can become the single most powerful force for creating positive, lasting change in corporate behavior.

It is critical for corporate leaders to address the impact of their policies and actions. By ignoring this impact they are creating risk for their customers, employees, shareholders, and themselves. Ultimately, companies that measure their success not just in terms of the next quarterly statement, but in years and decades, will be better able to evaluate and reduce their long-term risk. Shareholders have a responsibility to work with corporations to undertake this broader risk analysis, make this information available, and make sure that decisions are made that benefit their own long-term profitability as well as humanity and the planet.

A LOT OF McCUPS

To use a concrete example, let’s say that it’s early 2011 and you own $2,000 worth of McDonald’s stock. Every morning before work, you go through the drive-in and get an Egg McMuffin, hash browns, and a McCafe caramel mocha latte.

At work, you finish your coffee and, since the polystyrene foam cup is not recyclable, toss it in the garbage can—its first stop on the way to the landfill. You recall that McDonald’s got rid of the foam clamshell years ago—in 1990,7 in fact—and wonder why they’re still using cups made of the same material. Foam keeps the coffee warm, and it’s probably cheap to manufacture, but isn’t foam made of polystyrene, a petroleum-based plastic? Doesn’t it last forever, just crumbling into smaller and smaller bits that are ingested by birds and fish? Hasn’t the styrene used to make the cups been cited as a possible carcinogen?

The next morning at McD’s you ask if they have any other types of cups—maybe one that doesn’t break down into harmful particles of resin and can be more easily recycled? They tell you no, that’s it.

Later that day, you do a little research and learn that for their 68 million daily customers, McDonald’s is using foam cups at 35,000 restaurants in 118 countries! You also see that they have no recycling program (other than for cooking oil), and you do the math.8 It comes to about 770 million foam cups per year in the United States.

The next day, rather than go through the drive-through window, you go into the restaurant and ask some of the other customers if they think it would be a good idea for McDonald’s to switch to a more environmentally friendly coffee cup. Several of them like the idea. You bring this information to the manager, who says she’d like to switch, but it’s a franchise, and she must buy her supplies from McDonald’s. What power does she have?

You leave discouraged. As you drive to the office, it seems like every other person on the road is sipping from a foam cup. Throughout the day, you can’t stop thinking about those billions of cups strewn across the beaches of the world. You calculate that the Great Pacific Garbage Patch, which consists of small bits of plastic suspended throughout the water column9 now estimated to be twice the size of Texas, just keeps getting bigger. Finally, you had heard that the World Economic Forum predicted that there will be more plastic than fish, by weight, in the world’s oceans by 2050!10

The following morning you wake up with a brilliant idea: maybe you can get all of the owners of McDonald’s stock, like you, to vote on the idea of switching to a greener coffee cup. Like you, the other shareholders probably believe McDonald’s is a company destined to grow over the years. All those cups going to the landfills bother you and present a risk to the company. Also, as a shareholder, you feel it’s bad for the company brand to be associated with this toxic mess, because if people knew what was happening, that could drive the value of your shares down. Using foam cups when something better is available also shows that management is not thinking about the big picture, and you can’t help wondering what else they’re not considering.

But almost as soon as the idea to ask the company to use a more environmentally friendly cup occurs to you, you dismiss it. How would you get in touch with all the owners of the stock? And who would listen to your proposal, anyway? After all, you own just $2,000 worth of stock, and the company is worth more than $115 billion.11

The fact is, you’re in luck. As the owner of even $2,000 worth of stock that you have held for a year, you have the right to submit a shareholder resolution, which by law, if properly written, the corporation is obligated to put to a vote of all of its shareholders on the company’s shareholder proxy or ballot at their annual meeting.

This is exactly what happened in 2011 at As You Sow, the nonprofit organization that I lead.

After a dialogue asking McDonald’s to fix the problem went nowhere, we filed a shareholder resolution, asking the company to replace polystyrene cups with more environmentally beneficial ones. Our mission is to increase environmental and social corporate responsibility and engage companies on critical issues. These engagements often lead to filing a shareholder resolution, one of the strategies we employ to motivate corporations to act more responsibly.

Led by our Senior Vice President, Conrad MacKerron, who specializes in issues of sustainability and waste, we felt that McDonald’s needed just such a push. The company had switched away from polystyrene clamshells in 1990,12 so they clearly understood how switching to a less harmful cup could improve their sustainability and enhance their brand.

McDonald’s had never faced a shareholder resolution about this issue, and that was the game changer. The resolution came up for a vote and was approved by 29 percent of the shareholders.

Voting on shareholder resolutions is different than a standard political vote. If you were running for mayor and got only 29 percent of the vote, you’d likely consider it a failure. But think how a publically traded company would react to a hedge fund or a single shareholder who owned 29 percent of its stock. Such a person would likely be on their board and have enormous clout. Also the vote was a nonbinding recommendation to the company. The fact that a large minority of its shareholders voted in favor of moving away from harmful materials and avoiding the risks associated with it sent an important message to the company.

The vote brought McDonald’s management to the table for discussions, yet over the course of a year, they still had not taken any real action, so the resolution was filed again. This time, however, the shareholder action got more attention because of a successful campaign in California led by Clean Water Action, the SurfRider Foundation,13 and other local groups. The effort cosponsored groundbreaking legislation and helped support grassroots leaders to pass 65 local ordinances to ban polystyrene in restaurants.14 The California effort gained significant national press attention, and combined with shareholder pressure, was enough that McDonald’s agreed to a pilot program, swapping out foam for recyclable cups in 2,000 West coast locations. In exchange the resolution was withdrawn because the company “indicated its intent to take several positive, substantive steps in response to our concerns about use of polystyrene foam-based beverage cups and lack of a comprehensive recycling policy for on-site beverage and food containers.”

The pilot was a huge success with customers and in the press. A year later the program was rolled out to all 14,000 US stores. It also set a goal to reduce food and packaging waste by 50 percent in several top markets by 2020 that will require increased recycling efforts. McDonald’s periodically reports the results of its ongoing efforts to reduce packaging waste and the deployment of more environmentally responsible materials. It has a significant incentive to expand and improve its packaging stewardship programs, actions that are perceived positively by both shareholders and the public. Additionally, the positive brand image has huge value for the company—a win for McDonald’s, its shareholders, and the planet.

This is just one example of how active shareholders can step forward to present an opportunity for a company to shift a policy or adopt a better business plan and then lead an industry. Often it is a shift that management may not be considering but that will ultimately benefit the company in many ways. At the same time, shareholders, employees, and other stakeholders enjoy increased share value, and the environment gets a break, too.

THE POWER OF THE PROXY

You may be a novice investor, or you may be vastly experienced, but in all probability you aren’t really aware of the power you have as a shareholder. I wasn’t aware myself until I was introduced to my current job. Shareholders can have significant impact on the behavior of huge corporations on issues as diverse as human rights, diversity in the workplace and the board, carbon emissions, and much more. Shareholders have the right to engage corporate management—sometimes escalating to the filing of shareholder resolutions, which is one of the many tools available to investors who wish to promote more environmentally and socially responsible behavior on the part of companies in which they invest.

DOES ENGAGEMENT HARM CORPORATE PERFORMANCE?

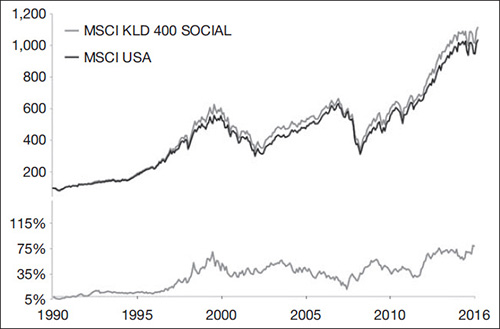

There are simple ways that every investor can directly impact and shape their investments to align with their values. You may be surprised to learn that the corporations that are more responsive to their shareholders and enact more positive ESG policies have improved performance. In fact, according to a Deutsche Bank Group report15 that looked at “more than 100 academic studies of sustainable investing around the world and then closely examined and categorized 56 research papers as well as two literature reviews and four meta studies,” the often-held assumption that sustainable investing yields “mixed results” is not accurate. In fact, the report shows that “Corporate Social Responsibility and most importantly, Environmental, Social, and Governance” (ESG) factors are correlated with superior risk-adjusted returns.” Furthermore, they state that 89 percent of the studies show that companies with high ESG ratings exhibit market outperformance and that “SRI fund returns show neutral or mixed results.”

This finding is backed up by research from TIAA-CREF16 that reports, “A TIAA-CREF analysis of leading SRI equity indexes over the long-term found no statistical difference in returns compared to broad market benchmarks, suggesting the absence of any systematic performance penalty.”

In addition, the California Public Employee Retirement System (CalPERS), the largest pension fund in the United States, has found that when it engages with companies in its portfolio, it sees increased returns. “Approximately 188 companies selected by the Pension Fund publicly and privately since 1987 on average outperformed the Russell 1000 by 14.4 percent over the five years after CalPERS began engagement, commonly referred to as the “CalPERS Effect.” The companies lagged the index by nearly 39 percent in the three years prior to CalPERS involvement.17

Finally, a June 2015 survey by the Certified Financial Analyst Institute18 (CFA) indicated that 73 percent of portfolio managers and research analysts take ESG issues into account in making investment decisions, with governance being the most common concern.

Figure 3: The responsible investing index with the longest track record, the MSCI KLD 400 Social index,19 started in 1990 as the Domini 400 Social Index. It is one of the first SRI indexes and has outperformed the S&P 500 index since its inception. If you had invested $1 million in 1990, you would have made $10 million in the S&P and $11 million in the MSCI KLD 400. Source: MSCI. Reprinted with permission. MSCI retains all other rights, title, and interest in and to the work.

This should not be a surprise. Companies that are less engaged with their shareholders are less open to new ideas and may not perceive risks. After all, a better management team—more aware of the impacts of corporate policy—will make better decisions and long-term investments to optimize efficiency and reduce risk. These attitudes at the board and management levels translate into long-term sustainable growth and become woven into the DNA of the corporation.

DISCREDIT WHERE DISCREDIT IS DUE

In 1970, economist Milton Friedman’s essay, “The Social Responsibility of Business Is to Increase Its Profits” argued that business basically had no responsibility other than to maximize profits for shareholders. However, the demonstrated success of socially screened investing and the emergence of corporate social responsibility initiatives have discredited Friedman’s view.

Now, many Fortune 500 executives enthusiastically endorse the notion of corporate social responsibility (CSR) as part of a company’s obligation to all stakeholders, including customers, employees, investors, and advocates, as well as something that pays its way. All of these activities can be evaluated by performance indicators, including reduced operating costs, enhanced brand image, increased sales and productivity, employee retention, and reduced regulatory costs and oversight. Some of the strategies and practices include:

• A commitment to diversity in hiring employees and barring discrimination

• Treating employees as assets rather than costs20

• Creating high performance workplaces that integrate the views of line employees into the decision-making processes

• Adoption of performance goals that go beyond compliance with environmental rules to promote measures to reduce ecological footprints, such as the United Nations Principles for Responsible Investment (UNPRI21) and the CERES Principles22

• Advanced resource productivity, focused on the use of natural resources in a more productive, efficient, and profitable fashion like maximizing recycled content and product and packaging recycling

• Responsibility for the conditions under which goods are produced down the entire supply chain and by contract employees domestically or abroad

• Transparent reporting on greenhouse gas emission, water use, and carbon footprint

INVESTOR CLOUT

The power to effect these meaningful changes in corporate behavior starts with voting your proxies, which a majority of shareowners either don’t do or leave to proxy voting services. If they do not vote, their votes are given to management. It’s as though investors are citizens and aren’t aware that they have the right to go to the ballot box to choose their elected officials.

However, through voting proxies, engaging with corporations, and initiating proxy votes about critical issues, investors can—and have—significantly influenced corporate behavior on issues ranging from lesbian, gay, bisexual, and transgender (LGBT) rights, board diversity, fair labor, and protecting the environment to corporate governance, hiring practices, animal rights, and many other issues.

The truth is, the dog slipped under the fence a long time ago. It’s time to bring it to heel.